-

The longer you wait to enroll, the higher your Part D late enrollment penalty will be — and it’s permanently added to your monthly Part D premium.

For every month you don’t have qualifying drug coverage, you’ll owe 1% of the national base beneficiary premium. This is a number Medicare calculates based on yearly enrollment data, which can change. So over time, your late enrollment penalty can also change, and even grow. Reference "Part D late enrollment penalty" on Medicare.gov.

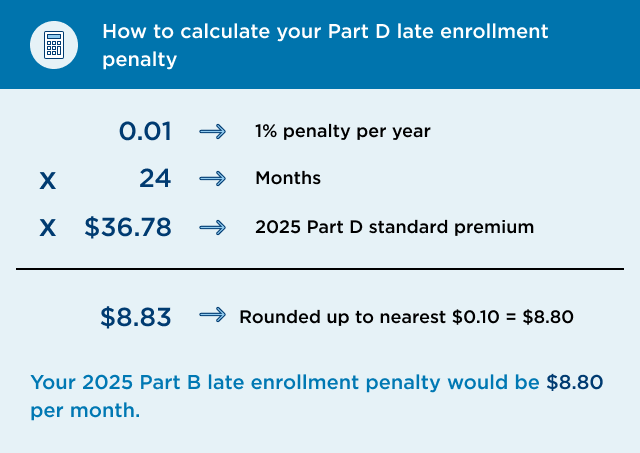

How to calculate your Part D late enrollment penalty

Example: If you waited 24 months (or 2 years) to sign up for Part D, you’ll have to pay a 24% late enrollment penalty. That’s 1% of the national base beneficiary premium for every month you waited.

- 1% penalty × 24 months x $36.78 (2025 base beneficiary premium) = $8.83

- $8.83 is rounded to the nearest $0.10 = $8.80

Your 2025 Part D late enrollment penalty would be $8.80 per month.

Medicare late enrollment penalties

Don’t get stuck paying late fees for Medicare

Medicare 7-month initial enrollment breakdown

These penalties aren’t one-time charges

They’re ongoing payments that are added to your Medicare premium every month you’re enrolled See footnote 1. To help you avoid costly fees, here’s a look at how these late enrollment penalties work and how to appeal them.

Medicare Part D late enrollment penalty information

-

You may be able to file an appeal if you had other qualifying prescription drug coverage when you enrolled, like:

- Medicare Advantage drug coverage or a stand-alone Part D plan.

- Qualifying drug coverage from your current or former employer or union, TRICARE, the Indian Health Service, or the Department of Veterans Affairs. They’re required to provide you with an annual notice of creditable coverage to let you know whether your drug coverage qualifies.

- Extra Help, also known as the Part D Low-Income Subsidy.

If any of these situations apply to you, you can file an appeal to request a review of your Part D late enrollment penalty.

If you didn’t sign up for Part D during your initial enrollment period, we’ll send you a letter notifying you of the penalties you may owe. You have 60 days from the date of the letter to file an appeal.

-

To learn more about:

- Medicare late enrollment penalties: Call Kaiser Permanente Member Services at 1-877-221-8221 (TTY 711), 7 days a week, 8 a.m. to 8 p.m. Pacific time.

- Late enrollment penalty appeals: Visit the Centers for Medicare & Medicaid Services website.

Medicare Part B late enrollment penalty information

-

A Medicare Part B late enrollment penalty increases your Part B monthly premium by 10% for every full year you’re not covered by Part B. Reference "Part B late enrollment penalty" on Medicare.gov.

The longer you go without coverage, the more expensive the penalty gets.

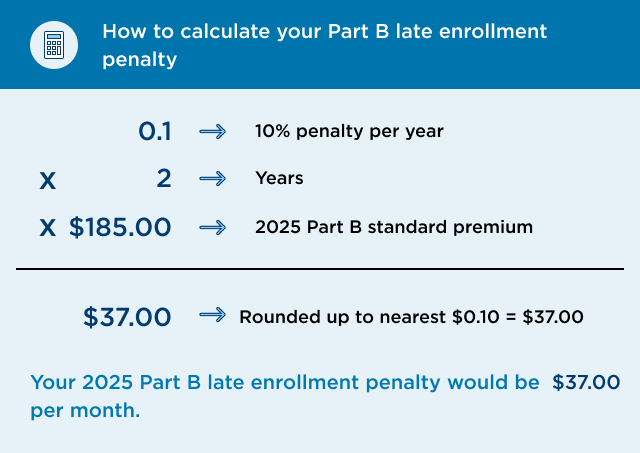

How do I calculate my Part B late enrollment penalty?

Example: If you waited 2 full years to sign up for Part B, you’ll have to pay a 20% late enrollment penalty. That’s 10% of your Part B premium for each year you waited.

- 10% penalty x 2 years x $185.00 (2025 Part B standard premium) = $37.00

- $37.00 is rounded to the nearest $0.10 = $37.00

Your 2025 Part B penalty would be $37.00 per month.

-

You may be able to file an appeal if you had other qualifying health coverage when you enrolled. Some qualifying health coverage providers could be:

- Your current or former employer or union

- TRICARE

- The Indian Health Service

- The Department of Veterans Affairs

If you did, they’re required to send you an annual notice of creditable coverage to let you know whether your coverage qualifies. And you’ll need to file an appeal to avoid paying a late enrollment penalty.

If you didn’t sign up for Part B during your initial enrollment period, you’ll get a letter in the mail from CMS notifying you of the penalties you may owe. You have 30 days from the date of the letter to file an appeal.

-

To learn more about:

- Part B late enrollment penalty: Call Social Security at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 7 a.m. to 7 p.m.

- Late enrollment penalty appeals: Visit the Department of Health and Human Services website.

Learn more about Medicare

Understanding enrollment periods

Learn about all the chances you have to sign up or switch plans.

Lower your prescription drug costs

Find out if you qualify for Extra Help (Part D Low-Income Subsidy).

Ready to start shopping?

Footnotes

- Kaiser Permanente is required to bill members the Part D late enrollment penalty on behalf of CMS/Medicare and is responsible for ensuring it’s billed appropriately. Continue at [1] - These penalties aren’t one-time charges